Innovative Training Strategies For Insurance: Featuring mLearning, Gamification, And Performance Support Tools

The industry can broadly be divided into two areas:

- Insurers who provide protection for the risks clients face.

- Insurance brokers who provide their expertise to ensure that their clients receive the best cover for the risks they face.

What are the typical training areas? Broadly, the training needs of the Insurance sector fall into the following categories:

- Industry-specific.

- Insurance industry skills training.

- Regulatory and technical training.

- Board and senior management training (to enhance their risk-based decision making skills).

- Generic.

- Sales and marketing.

- Business and people skills.

- Financial skills.

- Soft skills.

- Induction and onboarding.

What Are The Industry-specific Challenges?

As mentioned earlier, while the Insurance needs continue to grow with increase in population, infrastructure, and wealth, the Learning and Development teams in this sector have several challenges that need to be addressed. I am outlining the key Industry-specific challenges here:

- Regulated industry.

This mandates that the required trainings happen across the organization and within the stipulated time. It also requires that attestation of completion and records for the same are maintained meticulously. - Ongoing updates.

Similar to Finance and Healthcare, the need to ensure that the updates reach all users is very high. Not only does the learning strategy need to have a provision for speedy update, it also needs to ensure that these reach the users and get applied on the job. - High volumes of information.

- Globally spread out workforce.

How Can These Be Offset Using Innovating Training Strategies?

I believe that going beyond the traditional approach to training is essential to successfully offset the challenges and create a workforce that is agile and can respond effectively to the ever changing industry dynamics.

I am listing 3 such aspects that I have seen work well in Insurance sector training:

- Change the focus: From instructor-led training to blended and online to eLearning and mLearning.

This is absolutely essential to mitigate the challenges of being regulated, having work-force that is geographically spread out. It is also the only answer to ensure that the updation happens swiftly and reaches the employees on time. Specifically, offering mLearning enables learners to use eLearning on the device of their choice (tablets and/or smartphones) leading to better completion rates and higher retention. - Change the focus: Provide “learning as a continuum”.

This is often an ignored aspect in learning strategies. The Organizational Training Frameworks definitely map to the gap areas of Training Needs Analysis (TNA) or skill enhancements, but tend to rely largely on formal training. By definition, formal training happens for finite hours in a year and is rarely enough to help learners gain the required mastery. Instead, a holistic approach that uses a learning path that allows learners to create their own learning journey will lead to the required goals. - Change the focus: Use learner-centric rather than content-centric approaches.

The learning strategy must focus on learner-centric approaches that create immersive learning experiences. They ensure that the learners walk away with a feeling of time well spent and a sense of accomplishment at the end of the session.

Are There Any Success Mantras?

Certainly, here are the 5 Innovative training strategies that we have used in the Insurance sector:

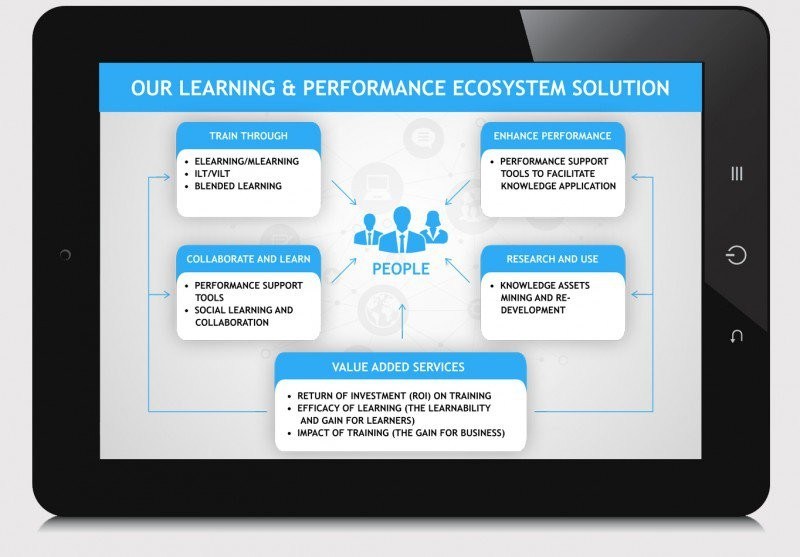

1. Opt for a "Learning and Performance Ecosystem".

Adopt a holistic approach to learning and performance. I am sharing a sample here. Particularly, leverage on collaborative learning by adopting social learning. Here is an example of our Learning and Performance Ecosystem solution that can be adapted for the Insurance sector easily.

2. Adopt mLearning.

You will see mLearning's impact in improving your course completion rates. Also, learners will spend more time on learning in contrast to traditional eLearning on laptops/desktops.

3. Opt for sticky learning approaches.

Use gamification, stories, and decision-making tools (branching scenarios and simulations) instead of boring and predictable instructor-led training or traditional eLearning.

4. Use Performance Support Tools.

Supplement or complement your formal training like interactive PDFs, eBooks, and mobile apps as “just-in-time” learning aids that are available to the learners precisely when they need them. This would push them to use these Performance Support Tools to apply the knowledge at work.

5. Add zing to standard instructor-led training programs.

Blend it with eLearning/mLearning or interesting Performance Support Tools that engage learners and more specifically push the knowledge acquisition to knowledge application.

I hope this article is useful in re-energizing your learning strategy. While I have dipped into my experience in handling approaches for the Insurance sector, most of these innovative training strategies can be applied successfully to other industries as well. Do reach out to me if you have any questions.