Product Is No Longer The Differentiator

Learning technology growth has followed a predictable pattern during most of the past decade: build a strong product, add more features than your competitors, and then let the demand follow. The truth is that this playbook no longer works.

In 2026, the EdTech market is crowded and mature. LMS, LXP, skills platforms, AI-powered learning tools, and compliance solutions all compete for the same budgets. Nowadays, buyers are more cautious. CFOs reduce spending while enterprise deals take longer. In the meantime, customer acquisition costs keep rising, and switching costs are lower than many vendors expect.

The hard truth in the market is this: great products are now table stakes.

What separates winning learning technology companies from those that stall isn't feature depth or UI polish. It's whether the CEO has built a business system around the product, one that connects product decisions directly to revenue outcomes.

The most successful learning tech CEOs don't just think like builders. They think like architects of growth. They obsess over monetization, go-to-market clarity, demand generation, and scalable revenue engines just as much as roadmap velocity.

You can see this shift clearly when looking at leaders behind some of today's most respected learning technology companies, from enterprise platforms shaping workforce transformation to HR tech innovators redefining how organizations upskill at scale. These CEOs aren't winning because their products are "better." They're winning because their learning tech growth strategy is intentional, aligned, and repeatable.

This article breaks down what learning tech CEOs do differently in 2026, and how they turn product strength into predictable, scalable profit.

In this guide, you will find...

- Why Product Excellence Alone No Longer Wins In Learning Tech

- The CEO Shift: From Builder-In-Chief To Growth Architect

- What Winning Learning Tech CEOs Do Differently

- Common Mistakes Learning Tech CEOs Still Make

- How Profitable Learning Tech Companies Build Revenue Engines

- Where Learning Tech CEOs Invest To Win In 2026

- The Role Of Trusted Industry Platforms In Accelerating Profit

Why Product Excellence Alone No Longer Wins In Learning Tech

Product excellence is not enough in the current market to succeed. That is because learning technology has entered a phase of market maturity, so most vendors in the EdTech market offer state-of-the-art features in their services. We have made a list of the most common services LMS, LXP, and learning solutions offer:

- Content delivery

- Analytics dashboards

- Integrations with HR systems

- AI-powered recommendations

- Mobile access

- Compliance tracking

Now, from a buyer's perspective, the differences are increasingly subtle.

Here are several forces that are reshaping the economics of a SaaS growth strategy:

- Market saturation. New learning technology companies continue to enter the market, while established vendors expand horizontally. The result is a noisy, crowded landscape where differentiation is hard to communicate.

- Longer buying cycles. Enterprise and mid-market buyers involve more stakeholders than ever, HR, L&D, IT, procurement, legal, and finance. Deals that once closed in months now stretch into quarters.

- Rising customer acquisition cost (CAC). Paid channels are more expensive. Organic reach is harder to earn. Buyers research independently for longer, often without filling out forms or engaging sales.

- Feature-driven competition. When every vendor competes on features, pricing pressure increases and margins suffer.

The key insight for learning tech CEOs in 2026 is this: the winners are not the companies with the most features but the ones with the clearest revenue strategy.

Product excellence is necessary, but it no longer drives growth on its own. Revenue growth now depends on how well the CEO connects product value to:

- A defined market

- A clear monetization strategy

- A disciplined go-to-market system

- Sustainable unit economics

Now that we have established the major change in the learning technology market, it is important to view it from the perspective of CEOs.

The CEO Shift: From Builder-In-Chief To Growth Architect

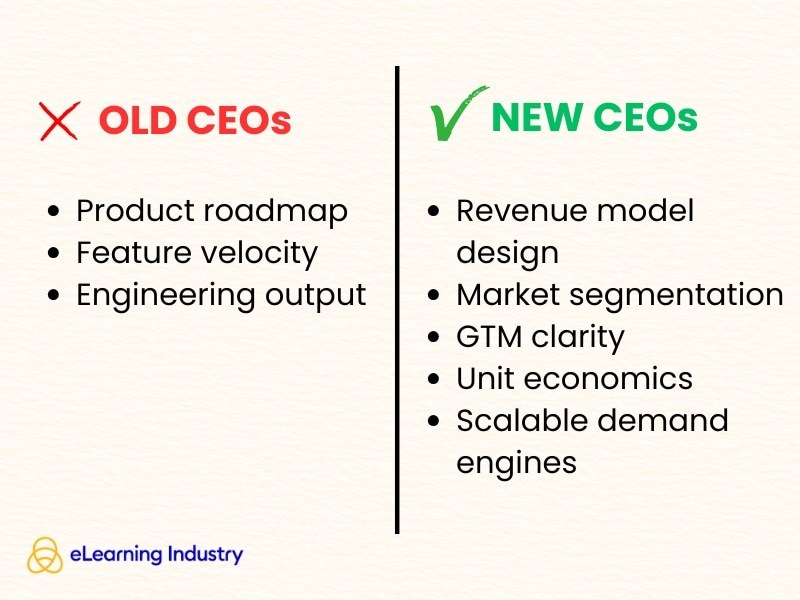

From the viewpoint of CEOs, the main difference between winning and losing learning technology vendors is how the CEO spends their time and attention. In this section, we present the old CEO focus and compare it with the new winning CEO focus in 2026.

The Old CEO Focus

The majority of learning tech CEOs still work in "builder mode," even after product-market fit. This mode consists of the following actions:

- Obsessing over the product roadmap

- Measuring progress by feature velocity

- Prioritizing engineering output

- Treating growth as something marketing or sales will "figure out"

Even though this mindset works in early stages, it yields different results at scale.

The Winning CEO Focus In 2026

2026 is bringing a new mindset for CEOs who want to see their companies thrive. Now, high-performing learning tech companies shift from builder to growth architect.

Putting it simply, their attention moves upstream and downstream from the product:

- Revenue model design: How does value translate into dollars?

- Market segmentation: Who exactly are we built for?

- Go-to-market clarity: How do buyers discover, evaluate, and choose us?

- Unit economics: Are we scaling profitably?

- Demand engines: How do we generate pipeline predictably?

This does not mean that CEOs abandon their products. On the contrary, it means that they treat their product as a component of a larger revenue marketing system. Here is a comparison between the old and the new winning model:

- Old model: Product-first thinking, feature velocity, shipping mindset, hope-driven growth.

- New winning model: Revenue-first thinking, market clarity, scaling mindset, and system-driven growth.

Learning tech CEOs who make this shift early build companies that grow with discipline, not luck.

What Winning Learning Tech CEOs Do Differently

Here is how the high-performers differentiate themselves from the rest of the competition in the 2026 learning technology market.

1. They Obsess Over ICP, Not Everyone

Winning learning tech CEOs are ruthless about focus. Instead of chasing all HR teams or any company with employees, they define:

- Clear ideal customer profiles (ICPs)

- Specific buyer personas (HR, L&D, CIO, operations)

- Priority industries and verticals

- Explicit "who we don't sell to" rules

This clarity drives everything in the company like:

- Messaging

- Product decisions

- Sales motions

- Pricing expectations

The impact is measurable with the following KPIs:

- Lower customer acquisition cost (CAC)

- Higher win rates

- Faster pipeline velocity

- Stronger customer lifetime value (LTV)

You can see this discipline in learning technology companies that dominate specific segments, whether enterprise compliance, frontline workforce training, or skills-based talent development. Focus creates leverage.

2. They Design Monetization Early, Not After Scale

Many learning tech companies treat monetization as something to "optimize later." Winning CEOs do the opposite.

They design monetization as part of the product and go-to-market strategy from day one.

This includes:

- Pricing aligned to customer value, not internal costs

- Modular packaging instead of one-size-fits-all plans

- Clear upgrade paths and expansion levers

- Add-ons for AI features, analytics, content, or services

Mindset is the key shift here. Basically, monetization now is a design decision and not a financial afterthought. That is why CEOs who get this right create businesses where growth compounds naturally through expansion, not just another new logo acquisition.

3. They Align Product, Marketing, And Sales Around Revenue

Misalignment is definitely one of the most damaging patterns in learning technology. To tackle this, CEOs must focus on the following:

- Product teams optimize for usage and features

- Marketing teams optimize for leads and traffic

- Sales teams optimize for closing deals

Winning learning tech CEOs eliminate these silos by aligning all three functions around revenue outcomes.

This alignment starts with shared measurable KPIs:

- Revenue and ARR growth

- Pipeline velocity

- Activation-to-paid conversion

- Expansion and net revenue retention (NRR)

It's reinforced through revenue operations (RevOps), the connective tissue that ensures:

- Marketing generates demand that the sales team can actually close

- Sales feedback informs product priorities

- Product usage data shapes go-to-market messaging

In mature learning technology companies, RevOps is not an operational detail. It's a strategic advantage.

CEOs who invest early in alignment reduce friction, shorten sales cycles, and create a predictable revenue engine that scales.

4. They Build Demand, Not Just Capture It

As it used to be, learning tech companies focused on capturing existing demand such as:

- Paid search

- Review sites

- Comparison pages

- RFP responses

However, winning CEOs understand that by the time buyers are "in-market," much of the decision has already been shaped.

That's why they invest in demand generation long before intent signals appear. This process includes:

- Thought leadership from executives

- Educational content

- Industry benchmarks and research reports

- Opinionated insights that challenge buyer assumptions

Therefore, instead of relying on existing demand, winning companies shape buyer thinking and, hence, create demand. This newly adopted approach lowers CAC over time and positions the company as a trusted authority and not as another vendor in an already crowded marketplace.

5. They Treat Go-To-Market As A System, Not A Launch

The norm before 2026 was to treat go-to-market (GTM) as a series of launches, like:

- New product launch

- New feature launch

- New campaign launch

Now, winning learning tech CEOs treat GTM as a living system. This system includes:

- Clear market segmentation and positioning

- Defined channels and acquisition motions

- Sales models matched to deal size and buyer maturity

- Continuous testing and optimization

Needless to say that in 2026, the most effective models are often hybrid:

- Product-led growth (PLG) to drive adoption

- Sales-assisted motions for expansion and enterprise deals

It is vital to remember that GTM success comes from coherence and not hype.

6. They Measure What Actually Predicts Profit

Measuring unimportant metrics consumes resources. Even though that is universally known, we witness companies still measuring vanity metrics like:

- Traffic

- Signups

- Demo requests

- Feature adoption

Nowadays, successful learning tech CEOs track what predicts sustainable revenue and profit. Some of these key metrics in 2026 include:

- LTV/CAC ratio

- Pipeline velocity

- Expansion ARR

- Activation-to-paid conversion

- Net revenue retention (NRR)

- Gross margin by segment

These metrics tell a clearer story about whether growth is healthy or fragile.

Common Mistakes Learning Tech CEOs Still Make

It is relatively easy to fall into traps in the current market. Even experienced leaders of learning tech companies may do so. In this section, we present some of the common pitfalls to avoid this year:

- Over-investing in features, under-investing in distribution. Shipping faster doesn't matter if buyers don't understand why you exist.

- Selling to too many segments. Never try to serve everyone. It is recommended that you focus on a specific target group. This will allow you to decrease CAC.

- Weak differentiation in crowded categories. You need a clear narrative to differentiate from the competition. Otherwise, potential buyers will rely solely on pricing and familiarity.

- No clear monetization ladder. We recommend avoiding flat pricing since it limits expansion and long-term revenue growth. Winning CEOs often have a clear monetization ladder.

- Treating marketing as a cost center. Strategic marketing is never an expense. It is a vital part of revenue strategy. This is how you should treat it, and it will pay off in the long run.

All these mistakes do not fail companies overnight, but they quietly cap growth.

How Profitable Learning Tech Companies Build Revenue Engines

Now that we have presented the pitfalls to avoid, it is safe to start building the revenue engines. It is a common theme among winning learning tech companies to connect EdTech business strategy to execution through revenue engines and not just tactics.

Typically, these engines include the following.

Content-Led Demand Generation

- Executive-level thought leadership

- SEO and long-form content mapped to buyer journeys

- Industry insights that build trust over time

Lead Generation Assets

- Research reports

- Webinars and virtual events

- Practical guides and benchmarks

Sales Enablement Aligned To Buyers

- Content mapped to each buying stage

- Proof points tailored to personas

- Clear value narratives for sales teams

Long-Term Nurturing

- Multi-touch engagement across months

- Education before conversion

- Trust-building for enterprise buyers

This is how learning technology companies create pipeline stability, even in uncertain markets.

Where Learning Tech CEOs Invest To Win In 2026

Winning in 2026 is less about reacting to trends and more about placing disciplined, strategic bets. That is why learning tech CEOs who outperform peers tend to invest in the same five areas, consistently and early.

1. Brand And Thought Leadership

Trust always compounds in a crowded learning technology market. To increase trust, CEOs invest in:

- Executive visibility and POV-driven content

- Research-backed insights and benchmarks

- Category narratives, not feature announcements

In terms of brand, it is no longer "soft." On the contrary, it directly impacts:

- Win rates

- Deal size

- Sales cycle length

- Enterprise credibility

It is a fact that the strongest learning technology companies are known before buyers enter the market.

2. AI-Ready Learning Offerings (With Clear Value Framing)

AI is not a nice-to-have or a future project anymore. It is the present and the future of the market. That is why it is important to have AI-ready learning offerings. This is also a crucial difference between the majority of the competition and the future-proof companies. The important thing is to know how to be positioned and monetized.

In a nutshell, winning CEOs focus on:

- Practical AI use cases tied to outcomes

- Transparent value communication

- AI packaged as a revenue lever, not a buzzword

In general, they avoid overpromising and underdelivering, a mistake that erodes trust fast.

3. Revenue Operations (RevOps)

RevOps is another option that has evolved from a nice-to-have to CEO-critical infrastructure.

Some of the investment areas include:

- Unified data across marketing, sales, and product

- Clear attribution and forecasting

- Predictable pipeline management

For scaling SaaS companies, RevOps is how B2B SaaS leadership turns insight into execution.

4. Enterprise Go-To-Market Capabilities

The enterprise vendors have their unique perks, and they behave differently in the market. Winning CEOs should understand this reality and adjust their investments accordingly.

These investments include:

- Sales enablement content

- Multi-stakeholder messaging

- Long-cycle nurturing programs

- Credibility-driven demand generation

Enterprise growth isn't rushed. It's orchestrated.

5. Data, Analytics, And Decision Intelligence

Relying on instinct alone won't cut it. The top learning tech CEOs know that they should analyze and base their decision on reliable data. So, they invest in:

- Predictive metrics

- Segment-level profitability analysis

- Unit economics visibility

The result? faster decisions, fewer missteps, and more confident growth bets.

The Role Of Trusted Industry Platforms In Accelerating Profit

Partnering with trusted platforms in the industry is always a valuable step in accelerating profit. Especially in today's market, where buying journeys have become longer and more research-driven. In short, the where and the how a learning tech company shows up matter the same.

In these partnerships, winning CEOs prioritize:

- Visibility where buyers actively research solutions

- Editorial context that builds authority

- Lead generation tied to high-value assets

- Campaigns designed for long sales cycles

- Consistent presence across the buyer journey

Rather than chasing attention everywhere, they invest in trusted ecosystems that already command buyer trust.

This approach amplifies:

- Brand credibility

- Demand quality

- Sales effectiveness

For learning technology companies, industry platforms accelerate growth by aligning visibility, trust, and conversion, not just traffic.

Conclusion

The key takeaway is that product excellence is no longer a competitive advantage. In 2026, it is the bare minimum requirement. The market is so crowded and filled with solutions that make CEOs step up their game to reach success.

In such packed environments, learning tech CEOs need to focus on many areas apart from their products. They need to design the revenue engine, treat go-to-market as a system, align teams around profit and not activity, invest in trust before intent, and build engines instead of campaigns.

Simply put, they need to understand a simple truth: Great products do not scale companies. Great revenue strategies do.

The learning tech CEOs who win in 2026 won't just ship great products; they will build machines that turn insight, trust, and demand into profit.

FAQ

Learning tech CEOs must focus on revenue strategy, go-to-market clarity, and sustainable unit economics. Product quality alone is no longer enough. Winning CEOs align product, marketing, sales, and RevOps around predictable ARR growth and profitability.

Learning technology markets are saturated, with feature parity across LMS, LXP, and AI learning tools. Buyers face more options, longer decision cycles, and higher scrutiny. Growth now depends on differentiation, positioning, and revenue execution, not just features.

Successful learning tech CEOs act as growth architects, not just builders. They design monetization early, prioritize ICP focus, invest in demand generation, and measure growth through metrics like LTV/CAC, pipeline velocity, and net revenue retention.

The most effective learning tech growth strategy combines:

- Clear ICP segmentation

- Value-based pricing and packaging

- Systematic go-to-market execution

- Authority-driven demand generation

This creates sustainable revenue instead of short-term pipeline spikes.

Pricing should reflect business outcomes, not features. Winning CEOs design modular packages, expansion paths, and add-ons (AI, analytics, services) early, ensuring monetization scales with customer value and usage.

Key CEO-level metrics include:

- LTV/CAC ratio

- Pipeline velocity

- Expansion ARR

- Activation-to-paid conversion

- Net revenue retention (NRR)

These metrics predict profitability better than traffic or lead volume.

Revenue operations (RevOps) is critical. It aligns marketing, sales, and product data into one revenue system, improving forecasting accuracy, pipeline visibility, and execution speed—all essential for scaling SaaS companies.

Demand generation shapes buyer thinking before purchase intent exists. Thought leadership, benchmarks, and research build trust and category authority, making future lead capture more efficient and lowering customer acquisition cost over time.

Enterprise sales require:

- Multi-stakeholder messaging

- Longer nurturing cycles

- Strong credibility and trust signals

- Sales enablement aligned to buyer journeys

CEOs who invest in enterprise GTM capabilities close larger, longer-term contracts.

Trusted industry platforms like eLearning Industry provide visibility, credibility, and high-intent demand in one place. They help learning tech companies influence buyers during research stages, shorten sales cycles, and support long-term revenue growth.