Discussing The Concept Of The Opportunity Cost

This gives the 'would-be' LMS buyer a seemingly enormous amount of choice especially if you add the LMS’s cousin, the Learning Content Management System (LCMS), into the mix. Things become more, rather than less complicated when subsequent research reveals that at least 90% of all LMSs’ features and functions are common to all such systems.

Price and the system’s capacity to scale could help to narrow down your choice; as will your decision over whether you want a Software-as-a-Service (SaaS)-based LMS or an open source LMS. Part of the problem is that, with the world of work changing rapidly, you can’t necessarily be sure what sort of system, features and/or functions will help meet your organisation’s needs even in the relatively short term.

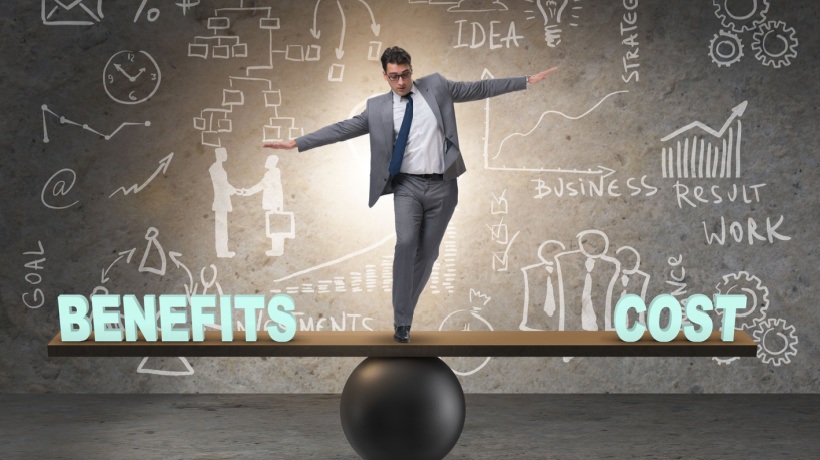

In the real world, purchasing decisions, as far as LMSs are concerned, are taken for a variety of reasons but one of the most often ignored factors in this decision is the opportunity cost.

Opportunity Cost

The concept of ‘opportunity cost’ is deceptively simple: every decision, notably every spending decision, can be set against the alternatives that we forego. So, if I spend some money buying something, I can’t spend that money to buy anything else. The cost is what I’ve spent; the opportunity cost is the cost of benefits that I’ve foregone, having bought what I’ve bought.

Since, by definition, opportunity costs are unseen, they’re often overlooked. Yet economists argue that understanding the potential missed opportunities foregone by choosing one opportunity over another allows for better decision-making. There’s even an approved calculation for finding the opportunity cost. It’s the return on the best-foregone option minus the return on the chosen option.

So far, so good, especially if you’re an economist.

Yet, how often do we consciously and rationally assess such a trade-off? According to FT columnist, Tim Harford, we’d make better decisions if we reminded ourselves about opportunity costs more often and more explicitly. Writing for FT | IE Business School Corporate Learning Alliance, Harford believes that such opportunity-cost calculations require us to be honest about our motivations.

Human brains are far from trustworthy and, as behavioural scientists point out, ‘individuals neglect information that remains implicit’, says Harford.

Habit Or Instinct

“We think we can summon to mind a clear image of a tiger,” he adds, “but, asked to draw a tiger, we start to struggle. It’s the same with opportunity cost. We spend money simply out of habit or instinct.”

Since we tend to make decisions – about what and when to buy, what and when to learn and, indeed, what and when to do anything – from habit and by instinct, calculating the true cost of our decisions is extremely difficult. That means that it’s easy for us to ignore the true value we place on what we buy, what we learn, what we do and so on.

Maybe, Harford suggests, we fail the ‘opportunity cost test’ because we don’t identify this cost precisely or because we’re not honest in how we assess it. We might buy something that’s expensive: a car, a wristwatch, an LMS and/or some learning materials, for example, not because of its higher quality but because we hope that it will impress our friends and colleagues. Maybe, we buy our LMS because organisational politics dictate the choice; perhaps, because the IT and/or finance department has a preference for a particular system.

For example, you might pay vast sums for, say, a wristwatch. Your choice may be justified by the timepiece's aesthetics, technical complexity or superior timekeeping. So, any opportunity cost calculation would weigh the alternatives against those stated benefits.

True Value

But the true value of that watch might lie in an indefinable pleasure associated with a brand image or a sense of exclusivity that derives purely from the high price itself, argues Harford compellingly. In that case, the trade-offs are harder to calculate and less likely to be made. These principles can be applied to buying anything, including LMSs.

This murky reasoning that influences our decisions and, so, underscores our purchases makes it hard for us to assess the alternatives realistically. Indeed, it’s this aspect of any purchase that marketers seize upon with glee and devote large amounts of their creative juices to reframing those motivations via their marketing messages and sales literature, including adverts.

This lends support to Harford’s argument that thinking harder about opportunity costs will help us make better decisions. It might also reveal something new, if also embarrassing, about ourselves. Nonetheless, concludes Harford, we need to be more honest with ourselves when making decisions.