The AI Landscape In 2026

Have you ever wondered how many AI companies are operating? 212,230 companies, of which 62,184 are startups. Not only that, but approximately 2049 new companies are founded annually. However, the majority of power and money is sitting on the laps of a few of the biggest AI companies that dominate our lives and whose products we use daily without even realizing it. When popular AI platforms first appeared, they were exciting, allowing us to seek answers and create images. But we've gone way beyond this very early stage. Now, AI tools are transforming many sectors.

For instance, in medicine, AI helps diagnose patients and determine the most personalized medication plan. In finance and banking, AI detects potential fraud, assesses risks, automates compliance, and offers personalized advice. In education, top AI companies offer personalized learning solutions, offering fully accessible options and empowering educators to focus on providing direction rather than grading papers. Also, in manufacturing, AI sensors predict maintenance needs before equipment fails, while helping companies optimize their supply chain.

AI skills are no longer optional. Your company has probably already adopted an AI solution. Knowing the biggest AI companies and their products helps you navigate this path and excel in your position.

In This Guide, You Will Find...

- What Makes An AI Company "Big" In 2026?

- The Most Influential AI Companies That Dominate

- How The Biggest AI Companies Shape The Future Of Artificial Intelligence

- Why Enterprise Buyers Gravitate Toward The Biggest AI Companies

- Risks And Challenges Facing The Biggest AI Companies

What Makes An AI Company "Big" In 2026?

1. Deep And Distinctive AI Foundations

- The biggest AI market leaders stay ahead because they control and constantly improve the models that power everything else.

- They're not just AI users; they're the builders, shaping massive systems that understand text, images, and even sound.

- Mid-sized companies are thriving by focusing on specific areas, like healthcare, law, robotics, and engineering, creating specialized models that solve narrow but valuable problems.

- Efficiency is now the new arms race. Success depends on running smaller, smarter systems that cost less, process faster, and balance work between the cloud and edge devices.

2. Seamless Integration Into Everyday Work

- The era of "look what our AI can do" demos is over. Winning companies are now embedding AI right into the tools people already use.

- Their strength lies in context awareness: the AI understands your goals, your data, and how your team works.

- APIs and plug-ins make adoption simple, like custom GPTs or enterprise integrations that create AI workflows with no friction.

3. Smarter, Scalable Business Models

- The early $20-a-month subscription trend is fading fast. Companies that last are the ones with flexible, usage-based, or enterprise-tier pricing.

- Corporate clients care less about novelty and more about privacy, reliability, and governance.

- As a result, enterprise-grade AI platforms are dominating the market over basic public chatbots.

4. Trust, Safety, And Data Transparency

- Regulation has arrived, and it's reshaping the AI landscape. The EU, US, and several Asian countries now have real frameworks guiding how AI is built and used.

- Companies that can show their data sources, prove their models are safe, and deliver reliable outputs are ahead of the curve.

- Transparency and ethical accountability have become competitive advantages for the biggest AI companies in the world.

5. Global Reach With Local Understanding

- AI may be global, but the best companies know how to think locally. They're building developer ecosystems filled with APIs, SDKs, fine-tuning tools, and marketplaces that encourage innovation.

- They also adapt to local languages, cultures, and regulations instead of trying to force a one-size-fits-all model.

6. Building AI Around People

- The best AI experiences feel natural.

- Companies winning in this space design products that are intuitive, emotional, and genuinely helpful, whether through voice, visuals, or personality-driven interfaces.

- Those who truly understand how humans build trust and collaborate with AI are setting themselves apart for the long term.

7. Learning From Every User

- The most successful AI systems never stop learning. They evolve safely by understanding how people use them, what they need, and what can be improved.

- Companies that let users shape their own AI personalization tools foster deeper loyalty.

- Once AI adapts to you, it becomes a lasting part of your workflow.

8. Winning Through Collaboration

- No one builds AI alone anymore. Artificial Intelligence companies partner with chipmakers like NVIDIA and AMD, work with regulators, and connect across industries.

- They also balance open-source collaboration with proprietary innovation, giving back to the community while protecting their edge.

- The real power comes from ecosystems, not isolation. Those who build bridges are defining the next phase of AI growth.

The Most Influential AI Companies That Dominate

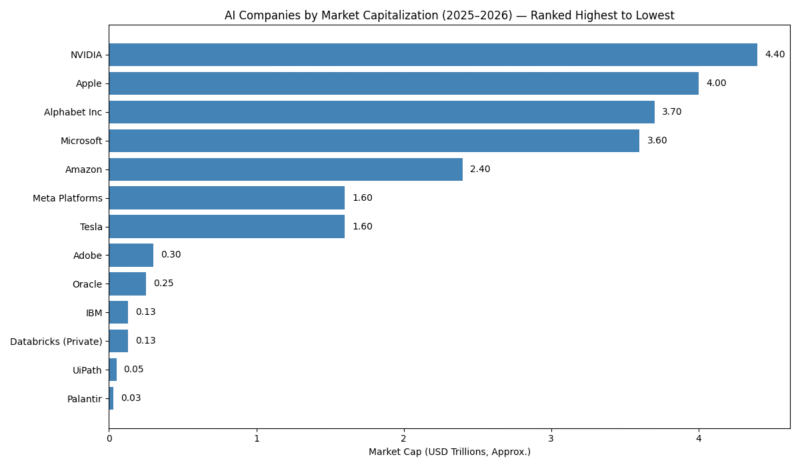

1. NVIDIA

NVIDIA is basically the engine behind modern AI and one of the leading AI companies shaping the industry today. Its GPUs, like the H100 and Blackwell series, power everything from massive research models to enterprise AI systems. It has maintained roughly a 92–94% share, far ahead of competitors like AMD and Intel, which gives it near-monopoly power in the hardware that fuels AI workloads.

Beyond hardware, NVIDIA provides software tools like CUDA and TensorRT that help developers optimize AI performance across industries including healthcare, robotics, and autonomous vehicles. This combination of hardware and software makes NVIDIA a cornerstone for anyone serious about AI.

Pros: One big advantage is the unmatched performance of its chips, widely adopted across the world. Additionally, its strong ecosystem makes it easier for developers to plug in, scale, and experiment.

Cons: NVIDIA's GPUs can be expensive, which may block smaller SaaS startups from accessing the latest tech. Supply chain delays occasionally slow delivery, and competitors are developing alternative hardware solutions that could challenge NVIDIA's dominance.

2. Microsoft

Microsoft has successfully embedded AI into almost everything it touches, and it's consistently counted among the biggest AI companies in the world. Tools like Microsoft 365 Copilot make Word, Excel, and Outlook smarter, while GitHub Copilot helps developers write code faster, and Azure AI gives enterprises tools to build, deploy, and manage models at scale. A major marker of its influence is revenue: Microsoft's cloud business generated over $75 billion in annual revenue, a cornerstone of its AI and cloud strategy.

Pros: One big advantage is its massive reach, as AI is already in the hands of millions through Microsoft's software and cloud products. Another pro is the strong security and compliance, which large organizations rely on.

Cons: Microsoft's sprawling portfolio can feel overwhelming for smaller businesses that are just starting with AI, and its pricing and licensing aren't always crystal clear. It also faces intense competition from Amazon Web Services and Google Cloud, both investing heavily in AI infrastructure and cloud tools.

3. Apple

Apple takes a slightly different approach to AI than some of the other largest AI companies, focusing on privacy, seamless integration, and user experience. Its Apple Intelligence powers features across iPhones, iPads, and Macs, improving Siri, predictive text, photography, and personalization. Apple's custom chips, like the Neural Engine in the A-series and M-series, enable powerful on-device AI while keeping data private.

The company's Services segment, which includes the App Store, iCloud, and Apple Music, recently generated around $100 billion in annual revenue, showing how AI-enhanced features contribute to both user experience and business growth.

Pros: Tight hardware-software integration, strong privacy protections, and a massive global user base giving new features instant reach.

Cons: The ecosystem is relatively closed, limiting third-party developer access. Some AI capabilities lag behind cloud-first competitors, and software updates roll out more slowly than on other platforms.

4. Alphabet Inc.

Google has embedded AI into much of our daily lives, making it one of the AI revenue leaders. Its core products, Search, YouTube recommendations, Gmail, and Gemini models, use AI to provide faster, smarter experiences. Developers and businesses can use Vertex AI to build custom models, while TensorFlow remains a staple for Machine Learning projects. Alphabet reported over $100 billion in total revenue in 2025, with Google Cloud contributing more than $15 billion, largely from AI-powered services and enterprise solutions.

Pros: Google's AI scale allows it to compete effectively in ChatGPT vs. Google, powering products that millions rely on daily. Its deep data access and research talent are unmatched.

Cons: Ongoing privacy concerns, regulatory scrutiny, and fierce competition from AWS and Azure.

5. Meta Platforms

Meta Platforms, another of the biggest AI companies, uses AI extensively to power content recommendations, ad targeting, moderation, and immersive experiences through its Reality Labs division. In 2025, Meta reported tens of billions in quarterly revenue, driven mostly by advertising that's increasingly optimized with AI‑based algorithms to improve engagement and conversion. The company is also investing heavily in next‑generation models like LLaMA and building massive AI infrastructure, with capital expenditures estimated at around $64–72 billion for the year.

Pros: Massive reach with billions of daily users across its platforms, strong ad-driven revenue growth enhanced by AI, and bold infrastructure investments positioning it for future AI innovations.

Cons: Heavy reliance on advertising, which makes revenue sensitive to market shifts; large AI spending, which can strain profits; and ongoing regulatory and privacy scrutiny. Some AI initiatives, like advanced LLaMA releases and Metaverse hardware, have also struggled to meet expectations.

6. Tesla

Tesla started as an electric car maker, but today it's also one of the AI market leaders thanks to its work on autonomous driving and robotics. Its Full Self‑Driving (FSD) software uses advanced neural networks and real‑world data from millions of vehicles to improve automation and navigation logic, and Tesla recently expanded into robotaxi services in select US cities. In Q3 2025, Tesla reported $28.1 billion in revenue, with growth driven by automotive, energy storage, and services revenue.

Pros: Tesla's massive fleet provides a rich source of real‑world data that fuels its AI models, and its brand recognition helps it attract talent and attention in both electric vehicles and autonomous systems. The company is also branching into energy products and other AI‑enhanced solutions beyond cars.

Cons: Tesla has seen vehicle deliveries and profits face pressure, and it lost its position as the world's top EV seller in 2025 amid intense competition. FSD adoption remains limited and controversial, with regulatory scrutiny and consumer hesitancy slowing both monetization and deployment.

7. Adobe

Adobe has fully embraced generative AI, and its tools are central to a category of generative AI companies transforming creative workflows. Products like Photoshop, Premiere Pro, Illustrator, and others now include AI‑powered features from Adobe's Firefly models that help users generate or enhance images, video, and design elements automatically. In 2025, Adobe reported record revenue of about $23.77 billion, with much of that growth credited to the integration of AI capabilities that boost productivity and unlock new creative possibilities for individuals and enterprises.

Pros: Its AI tools help eliminate repetitive tasks and accelerate creative work, and many customers view them as indispensable for professional content creation. The company also benefits from long‑term subscription revenue that creates financial stability.

Cons: Some critics worry that generative AI could erode artistic originality and devalue creative labor. Adobe's stock performance has been mixed, and competition from newer, more nimble AI-native creative tools means it must keep innovating to stay ahead.

8. Palantir

Palantir is known for its powerful data analytics and integration platforms, including Gotham and Foundry, which serve government, defense, and commercial clients. It's often included with AI cloud providers that help organizations make sense of massive datasets and operationalize Machine Learning insights at scale. In 2025, Palantir raised its full‑year revenue guidance, projecting around $4.1 billion to $4.4 billion, driven by strong demand for its AI‑linked services across sectors and record quarterly performances that topped $1 billion in revenue.

Pros: Deep specialization in complex data environments and long‑term, high‑value contracts, especially with government agencies that provide revenue stability. Also, its AI platforms and tools are highly customizable for mission‑critical use cases.

Cons: Palantir's solutions can be expensive and complex to implement, which can limit adoption among smaller organizations. Its association with sensitive government work also draws ethical scrutiny and regulatory complexity.

9. Amazon

Amazon is one of the biggest AI companies in the world, using AI across both consumer and enterprise fronts. On the enterprise side, AWS offers Machine Learning services like SageMaker, Bedrock, Lex, and Polly that let developers build and deploy AI models in the cloud. On the consumer side, Alexa brings voice‑activated AI into millions of homes. AWS continues to dominate the global cloud infrastructure market with roughly 30% share, which translates to over $100 billion in annual revenue just from cloud services.

Pros: Massive cloud infrastructure that supports developers and enterprises at scale, as well as the breadth of AI services available within AWS. AI also enhances operational divisions such as logistics, personalization, and retail.

Cons: On the downside, AWS faces stiff competition from Microsoft Azure and Google Cloud, and Alexa's performance and privacy perceptions lag behind some rivals. Amazon's sprawling business model means AI focus can sometimes feel diluted across many different products and divisions.

10. IBM

IBM continues to carve out a niche among leading AI companies with its Watsonx platform, designed for enterprise AI workloads with an emphasis on model training, governance, and explainability. Watsonx integrates with data services and helps clients in regulated industries like healthcare and finance build, manage, and oversee ML and generative AI systems. IBM pairs AI with its hybrid cloud strategy to offer solutions that blend on‑premises and cloud deployments for large organizations. In 2025, IBM continued growing, reporting quarterly revenue above $16 billion, with its AI‑related business (including consulting, software, and hybrid cloud services) expanding.

Pros: IBM's long history in enterprise computing and strong reputation for security and compliance make it attractive to conservative IT buyers. Its focus on explainable AI and governance resonates with regulated industries.

Cons: IBM's overall growth is slower than that of nimbler cloud and AI‑first companies, and Watsonx's developer adoption isn't as broad as hyperscaler AI platforms. Some customers find the platform's complexity a barrier without specialized expertise.

11. Oracle

Oracle is a long‑standing enterprise software giant that embeds AI throughout its cloud infrastructure and applications to help businesses automate workflows and analyze data at scale. The company generated roughly $57.4 billion in total revenue, with cloud services and license support contributing a large portion of that and rapidly growing year‑over‑year as more customers adopt AI‑enabled cloud products. Its Oracle Cloud Infrastructure (OCI), databases, and analytics tools support enterprises in cloud migration, automation, and predictive insights, making Oracle's platforms a backbone for many mission‑critical enterprise systems.

Pros: Oracle's deep integration with enterprise systems, strong governance and security, and stable subscription revenue make it a reliable choice for large companies. Also, its AI platforms can boost operational efficiency and decision‑making across business workflows.

Cons: It often trails hyperscale cloud competitors in developer mindshare, and some customers feel its AI offerings are more evolutionary than breakthrough innovations. Adoption can also be complex for smaller teams without enterprise IT experience.

12. UiPath

UiPath is known as one of the AI innovation leaders in robotic process automation and agentic AI software, helping businesses automate repetitive tasks and workflows across finance, HR, customer service, and beyond. The company generated about $1.43 billion in revenue, with trailing‑twelve‑month revenues around $1.55 billion as of late 2025, showing solid growth as organizations embrace AI‑driven automation. Its platform includes tools that combine rule‑based automation with Machine Learning to interpret documents, route tasks, and automate complex processes.

Pros: Rapid ROI from automating routine work, a user‑friendly interface that accelerates adoption, and measurable productivity gains that resonate with enterprise customers. Also, it achieved profitability in recent quarters, indicating a more sustainable financial path.

Cons: Its overall revenue is smaller than hyperscale cloud or foundational model providers, limiting its reach in broader AI markets. The competitive landscape is also heating up, with larger platforms bundling automation into broader AI suites that could undercut UiPath's standalone appeal.

13. Databricks

Databricks ranks among the top enterprise AI companies with its unified data lakehouse platform that brings data engineering, analytics, and Machine Learning together in one environment. As of 2025, Databricks has surpassed an annual revenue run rate of over $4.8 billion, with more than $1 billion of that coming specifically from AI‑related products, showing strong momentum and broad adoption among large organizations building AI applications and analytics workflows.

Pros: Rapid revenue growth, strong enterprise demand for unified data and AI platforms, and a powerful suite of tools that simplify complex data pipelines and AI deployments. Its partnerships with major cloud providers further strengthen its reach.

Cons: The platform can feel complex for smaller teams without dedicated data engineering expertise, and its pricing may be high for mid‑market customers.

How The Biggest AI Companies Shape The Future Of Artificial Intelligence

From AI adoption in L&D to enterprise operations, companies are using AI to personalize training, automate tasks, and make smarter decisions. At the same time, AI regulation is evolving worldwide, requiring companies to balance innovation with safety and ethics. Here's how leading AI companies shape the future.

-

Advanced Infrastructure

Investing in high-performance hardware and core AI models to power research, applications, and enterprise solutions.

-

Seamless Integration

Embedding AI into daily workflows, software platforms, and business processes to make adoption easier.

-

Scalable Monetization

Offering subscription, usage-based, or enterprise licensing models to turn AI into sustainable revenue streams.

-

Trust And Compliance

Prioritizing safety, transparency, and adherence to global AI regulations.

-

Ecosystem And Partnerships

Building developer communities, APIs, and collaborations to extend reach and innovation.

-

Human-Centered Design

Creating AI that is intuitive, interactive, and enhances human decision-making.

-

Continuous Learning And Customization

Enabling AI systems to adapt, learn from users, and offer personalized experiences.

Why Enterprise Buyers Gravitate Toward The Biggest AI Companies

Enterprise buyers gravitate toward the biggest AI companies because they offer scale, reliability, and proven expertise that smaller providers often can't match. These companies provide advanced solutions, from Generative Engine Optimization (GEO) that boosts productivity and content creation to robust analytics platforms that integrate seamlessly into existing workflows. They also lead in responsible AI, ensuring models are safe, auditable, and compliant with evolving regulations. Enterprises value not only the technology but the trust, governance frameworks, and global reach these companies bring, making adoption faster, safer, and more strategic for complex business environments.

Risks And Challenges Facing The Biggest AI Companies

-

Regulatory Pressure

Even AI market leaders face growing scrutiny from governments worldwide as new policies emerge, forcing them to adapt quickly to complex and evolving AI regulation standards.

-

Data Privacy Concerns

Protecting sensitive information remains a top priority, especially as global enterprise adoption of AI grows and companies depend on vast amounts of user data for decision-making.

-

Ethical Responsibility

Maintaining responsible AI practices and ensuring systems are transparent, fair, and unbiased are ongoing challenges in a competitive market.

-

High Operational Costs

Running and scaling large models demands billions in infrastructure spending, putting smaller players at a disadvantage and testing the efficiency of the broader AI ecosystem.

-

Market Saturation

As competition intensifies, companies need innovative AI marketing ideas to stand out and communicate the real value of their technology beyond hype.

-

Talent Scarcity

The shortage of skilled AI engineers, researchers, and ethicists makes hiring expensive and slows innovation cycles.

-

Public Trust And Misinformation

Misuse of generative tools can erode credibility, pushing companies to double down on verification and transparency efforts.

-

Environmental Impact

Training massive models consumes huge amounts of energy, forcing AI companies to prioritize greener, more sustainable operations.

Key Takeaway

The biggest AI companies in the world are setting the pace for how technology evolves, driving innovation, influencing markets, and shaping how we live and work. From AI chip companies powering massive models to cloud providers deploying smarter systems globally, every layer of the AI ecosystem is expanding fast. We're also entering a new era of search and discovery, where tools like Google AI Overviews are redefining how users find and trust information.

But with growth comes responsibility. Companies now need a clear AI strategy, one that combines innovation with ethics, governance, and sustainability. As the industry continues to mature, celebrating excellence and responsible progress matters more than ever. That's why participating in eLearning Industry's AI Excellence Awards is an excellent way to receive the recognition you deserve and stand out from your competition.

For emerging players shaping what’s next, see our upcoming guide to the hottest AI startups.

FAQ

Companies leading in AI technology include giants like Nvidia, Microsoft, Google/Alphabet, OpenAI, and others shaping the AI landscape.

Criteria include revenue, valuation, technology adoption, compute capacity, and market influence.

While most of the top AI companies are large, established corporations, mid-sized companies and startups are also thriving, especially by building specialized models for narrow, high-value sectors (such as healthcare, law, robotics, and engineering).

AI companies will shape investment trends by driving revenue growth and valuation through enterprise AI adoption and scalable business models, as well as making AI infrastructure more attractive to investors.

- Investment in advanced infrastructure and core models

- Seamless integration of AI into daily workflows

- Scalable monetization (usage-based/enterprise pricing)

- Emphasis on trust, safety, and compliance

- Expanded ecosystems and partnerships

- Human-centered design

- Continuous learning and customization of AI systems

The following AI companies are innovating in foundation models and generative AI:

- NVIDIA – hardware and software that power large models.

- Microsoft – Copilot, Azure AI, and enterprise model platforms.

- Alphabet (Google) – Gemini models, Vertex AI, TensorFlow.

- Meta Platforms – LLaMA family and large-scale model infrastructure.

- Adobe – Firefly generative models integrated into creative tools.

- Amazon (AWS) – SageMaker, Bedrock, and cloud-based model services.

- IBM (Watsonx) – enterprise model training and governance.

AI hardware companies focus on the infrastructure layer: designing chips and performance-optimization software that power model training and deployment.

On the other hand, AI software companies focus on the model, platform, and application layers: building foundation models, enterprise platforms, and generative tools that analyze data, automate work, and integrate into workflows.

Instead of building broad, consumer-facing platforms, startups and mid-sized firms focus on narrow, high-value domains such as healthcare, law, robotics, engineering, and enterprise automation.

They also compete through efficiency by building smaller, cheaper, faster models.