Companies Are Increasing Their AI Investments More Than Ever

In 2024, corporate AI investments rose to an astounding $252.3 billion, a 13-fold increase since 2014. However, just because companies are spending more on AI tools, it doesn't mean that the economic impact is strong. On the contrary, many companies report low returns from their AI spending. Why is that, though? There are many reasons why your monetary returns aren't positive yet. For starters, you may be making the wrong investments. Do you purchase tools because they are valuable to your business or because they are trending? Does your workforce know how to leverage the full list of capabilities of a tool?

Plus, are you clear on how you want your team to use a tool and what results you expect? Ensuring that your team has the necessary AI skills is monumental. But it's not the only factor. As a business owner and CEO, you must know exactly why you're using a tool and how it can help your company reach its goals. You need a well-crafted AI investment strategy, not an experimentation phase.

This article dives into the areas that other companies are focusing their AI spending on, why experimentation isn't viable anymore, and how leaders evaluate AI investment ROI. This is the time to take a large step forward and prepare your company for what's next.

TL;DR

- Smart companies are shifting AI investments from experimentation to scalable impact.

- AI spending is concentrated in data, platforms, talent, and enterprise use cases.

- Strategic AI investments prioritize long-term value over short-term efficiency.

- The biggest returns come from focused allocation, not broader budgets.

In This Guide, You Will Find...

- Why Does Investing In AI Matter So Much?

- AI Investment Vs. AI Experimentation

- Where Smart Companies Are Investing In AI Right Now

- How AI Investment Priorities Differ By Company Type

- How Leaders Evaluate AI Investment ROI

- Why AI Investment Visibility Shapes Market Perception

- What Smart Companies Are Not Investing In

- Common AI Investment Mistakes To Avoid

Why Does Investing In AI Matter So Much?

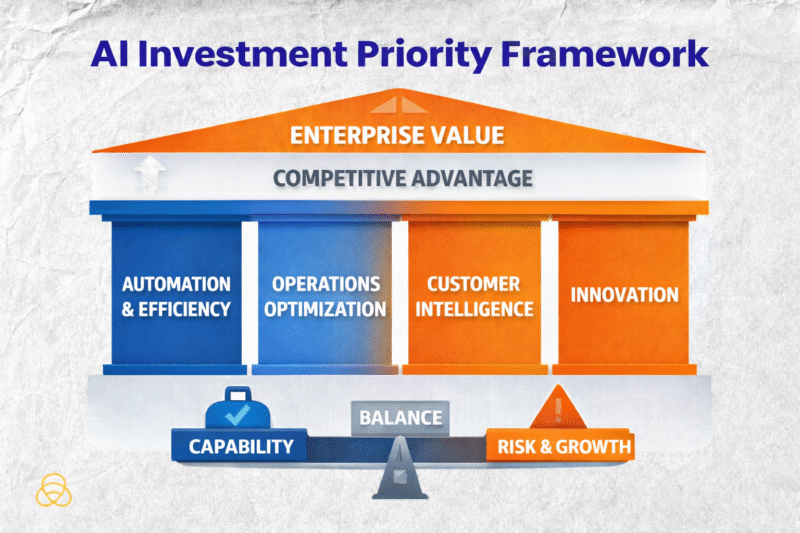

AI growth investments are rising fast, but bigger budgets don't guarantee results. Boards and investors expect AI ROI, not just pilots, and capital allocation signals your company's long-term strategy. This is why a well-organized AI strategy matters:

- AI budgets are growing, but expectations are higher than ever.

- Boards want measurable returns, not just experimental projects.

- Where you invest shows your strategic priorities.

- Lack of focus can waste resources and slow progress.

The companies that lead in AI treat it as a strategic capability, not a trend. They focus on clarity, discipline, and measurable outcomes. This is the steps they take to ensure actual results:

- Long-term perspective: AI is integrated deeply into operations, not treated as a one-off project.

- High-conviction bets: Resources go to initiatives with the greatest potential impact.

- Aligned with business goals: AI growth investments drive meaningful change.

- Experimentation vs. scale: Pilots are tested, but only proven initiatives expand, ensuring every AI innovation investment delivers real growth.

AI Investment Vs. AI Experimentation

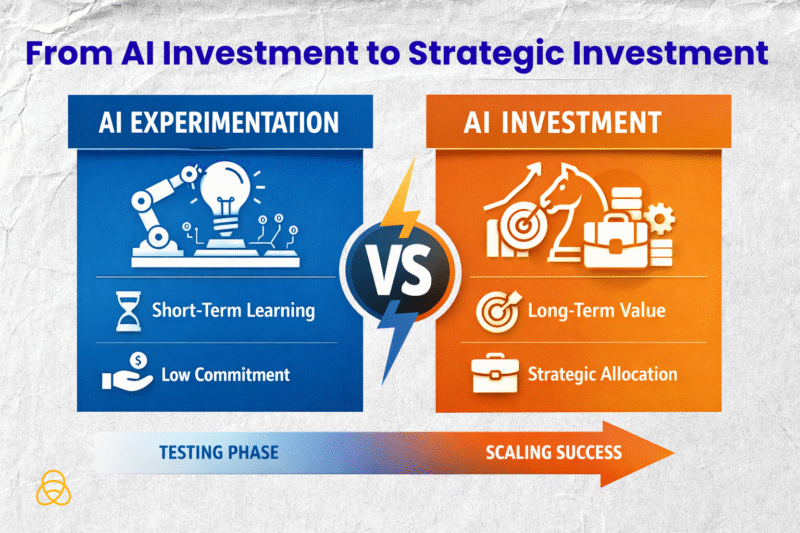

Artificial Intelligence investments are about commitment, not just curiosity. When companies shift from testing to investing, they dedicate resources, align teams, and integrate AI tools into core operations. Clear objectives guide AI budget allocation, ensuring that every dollar spent supports measurable outcomes. Leaders focus on scaling proven solutions rather than chasing every new feature, embedding AI deeply into business processes. Also, establishing robust AI workflows and defining success metrics allows organizations to maximize value and avoid fragmented efforts. Investment signals a long-term strategy where AI becomes a true driver of efficiency, innovation, and growth.

On the other hand, experimentation is the learning stage, where companies explore new possibilities without full commitment. Small pilots and controlled tests allow teams to understand potential impacts, refine processes, and gather insights. During this phase, AI spending is carefully targeted to reduce risk while still enabling discovery. Teams test different approaches, identify what works, and uncover challenges before scaling. The goal is knowledge, not immediate ROI.

Where Smart Companies Are Investing In AI Right Now

1. Data Foundations And Infrastructure

Strong AI starts with reliable data. Companies investing in foundational systems ensure that information is accurate, accessible, and secure. High-quality data enables AI to deliver meaningful insights, reduces operational friction, and sets the stage for scalable innovation. Understanding AI funding trends helps leaders prioritize these foundational investments.

- Data quality and governance frameworks

- Cloud and AI-ready architecture

- Integration layers across business systems

- Master data management

- Real-time analytics pipelines

- Metadata management for discoverability

2. Enterprise AI Platforms

Scalable AI requires platforms that unify tools, processes, and insights. By centralizing capabilities, companies reduce redundancy, enable faster experimentation, and make AI solutions reusable across the organization. This is a key reason the biggest AI companies dominate, as they standardize and scale intelligently.

- Centralized governance and oversight

- Platform over point solutions for efficiency

- Reusable AI modules across teams

- Monitoring and performance dashboards

- API-driven integration capabilities

3. Talent And Organizational Capability

Even the best technology fails without the right people. Investing in AI leadership, reskilling teams, and fostering internal literacy ensures your workforce can leverage tools effectively and drive innovation.

- AI marketing leadership roles and centers of excellence

- Upskilling programs for technical and non-technical staff

- Change readiness and adoption initiatives

- Internal AI literacy campaigns

- Cross-functional collaboration for AI projects

4. AI Embedded In Core Operations

AI is most impactful when embedded in everyday business processes. From finance to supply chains, automation and decision support enhance efficiency while creating strategic advantages. Companies must design workflows thoughtfully to maximize benefits.

- Operations, supply chain, and finance integration

- Decision support and predictive analytics

- Automated workflows for repetitive tasks

- Risk reduction through predictive modeling

- KPI-driven process optimization

5. Customer And Market-Facing AI

AI transforms how companies understand and serve their markets. Personalization, demand forecasting, and insights into customer behavior improve engagement and revenue, making this area a frequent target of AI investments. For instance, comparing ChatGPT vs. Google demonstrates how market-facing AI can influence customer experience strategies.

- Personalized marketing and recommendations

- Customer intelligence and sentiment analysis

- Demand and sales forecasting

- Market trend detection

- Dynamic pricing and promotions

6. Governance, Risk, And Responsible AI

As AI adoption grows, risk management and compliance are critical. Companies invest in frameworks that ensure AI is transparent, trustworthy, and aligned with ethical standards. Monitoring and reporting processes safeguard both the business and its reputation.

- Compliance readiness and audits

- Risk mitigation frameworks

- Transparency and explainability tools

- Responsible AI policies and ethics boards

- Data privacy and cybersecurity safeguards

- Bias detection and correction

7. AI-Driven Product Innovation

Leading companies are channeling AI into product development, not just operations. From idea generation to post-launch optimization, AI helps businesses design smarter, faster, and more customer-centric products. This area has become a major focus of enterprise AI investment, as organizations seek to blend data, creativity, and automation to stay ahead of competitors.

- Predictive analytics for product demand and feature planning

- Rapid prototyping using AI-assisted design tools

- Automated quality assurance and testing

- Voice-of-the-customer feedback loops for product refinement

- Smart sensors and IoT data for ongoing performance insights

8. AI-Powered Customer Support And Experience

Customer expectations are evolving, and AI is transforming how businesses respond. Intelligent support systems now combine automation with empathy, helping brands deliver faster, more personalized service. Many B2B customer service examples show that predictive support and natural language processing can strengthen loyalty and improve satisfaction across every touchpoint.

- AI chatbots and virtual assistants for real-time support

- Predictive service alerts to resolve issues before they occur

- Sentiment analysis to gauge customer satisfaction

- Multilingual natural language processing for global support

- Automated ticket routing and service analytics for efficiency

How AI Investment Priorities Differ By Company Type

Enterprise Organizations

Large enterprises approach AI with long-term goals and structured governance. Their priority is aligning AI with broader corporate strategy to drive efficiency, scale, and measurable ROI. Enterprise AI investment focuses on integrating AI into core operations rather than isolated projects.

- Standardizing AI workflows across departments

- Centralizing data infrastructure for analytics at scale

- Automating repetitive processes while monitoring KPIs

- Developing robust governance and compliance frameworks

- Strengthening workforce AI literacy for cross-functional teams

Mid-Market Companies

Mid-market firms often balance agility with resource constraints. Their AI focus is on quick wins that demonstrate measurable impact while laying the groundwork for future expansion.

- Prioritizing initiatives that boost operational efficiency

- Experimenting with customer-facing AI for immediate benefits

- Streamlining processes through automation

- Investing in staff upskilling for scalable adoption

- Aligning AI projects with revenue growth opportunities

Regulated Industries

Industries with strict regulations focus on compliance, risk management, and transparency. AI adoption is often cautious, with investment decisions driven by safety, ethics, and regulatory readiness.

- Embedding AI into critical operations with safeguards

- Maintaining rigorous documentation and audit trails

- Monitoring for bias and explainability

- Enhancing reporting and compliance workflows

- Supporting innovation while reducing legal and operational risk

Platform Vs. Services Businesses

Platform-based businesses prioritize scalable AI capabilities, while service-oriented companies focus on personalization and client outcomes. AI personalization tools can drive differentiation in services, whereas platforms often focus on efficiency and modularity.

- Platforms: scalable AI modules, performance monitoring, reusable frameworks

- Services: tailored solutions, client-focused decision support, automated workflows

- Both: aligning AI adoption with strategic goals and ROI measurement

- Supporting global expansion strategies with AI-driven insights

- Planning AI growth investments to optimize long-term value

How Leaders Evaluate AI Investment ROI

-

Leading Vs. Lagging Indicators

Smart leaders don't just look at results after the fact—they track early signals that show whether AI initiatives are on the right track. Leading indicators might include adoption rates, workflow improvements, or team engagement with AI tools. These early signs guide adjustments and help ensure that long-term outcomes align with expectations, giving executives foresight into potential ROI before it fully materializes.

-

Strategic Impact Vs. Efficiency Gains

Not all wins are immediate. Some AI projects drive operational efficiency, like faster reporting or automated tasks, while others build strategic advantages, such as opening new markets or enhancing customer experiences. Evaluating both helps boards understand the full value of AI, beyond just cost savings. Awareness of AI investment trends often informs which initiatives carry the highest strategic potential.

-

Capability-Building Metrics

Investing in AI is also about strengthening the organization. Leaders measure success by how well teams adopt AI workflows, develop skills, and gain confidence in using new tools. Metrics focus on readiness, internal literacy, and cross-functional collaboration—ensuring the company is building capabilities that pay off over time. Leveraging insights from Google AI Overviews can inform which areas need additional support.

-

Risk-Adjusted Value

Every AI initiative carries some level of risk, from ethical concerns to execution challenges. Boards assess projects by weighing potential gains against risks, making sure that resources are used wisely. Incorporating concepts like generative engine optimization (GEO) or other safe experimentation strategies ensures investments are measured and sustainable. Proper AI capital allocation allows companies to maximize returns while minimizing unexpected costs.

Why AI Investment Visibility Shapes Market Perception

-

Investment Signals Innovation Maturity

Visibility matters. When a company is transparent about its artificial intelligence investments, it sends a message that it's not just experimenting, but scaling responsibly. Investors, partners, and customers see openness as a sign of confidence and readiness. Sharing progress, lessons learned, and measurable outcomes helps position your organization as a mature innovator, not just a participant in the AI race.

-

Buyers Evaluate Long-Term Partners

Clients today want to work with organizations that can sustain innovation, not just deliver quick wins. Visibility into AI investment priorities gives buyers confidence that a company is building durable capabilities. It also demonstrates that leadership has a roadmap for integrating AI strategically across departments, turning technology into long-term value rather than short-term hype.

-

Markets Reward Clarity, Not Secrecy

The market pays attention to clarity. Companies that articulate how they're investing in AI attract investor trust and talent alike. Transparency about strategy and progress invites accountability and positions the company as a credible, forward-looking player. Silence, on the other hand, often signals uncertainty or lack of direction.

-

Thought Leadership Reinforces Credibility

Publicly discussing how AI supports broader goals, like sustainability, customer experience, or AI adoption in L&D, reinforces leadership credibility. It shows that your company understands the human side of innovation and values continuous learning. By sharing real insights instead of abstract promises, you demonstrate both authority and authenticity, strengthening your position in the market.

What Smart Companies Are Not Investing In

-

One-Off AI Pilots

Smart companies have learned that running endless pilots without a path to scale is a waste of both time and money. Instead of short-term experiments, they focus on AI technology investment that can grow with the business. Pilots are valuable only if they lead to sustainable implementation. Otherwise, they become learning exercises with no real payoff.

-

Isolated Tools With No Reuse

Buying disconnected tools may feel like progress, but it often creates more problems than it solves. Forward-thinking organizations prioritize integrated systems that share data and insights across teams. This ensures scalability, consistency, and measurable results. They understand that efficiency comes from connection, not a patchwork of single-purpose software.

-

AI Without Data Readiness

Without clean, structured, and accessible data, even the most advanced algorithms can't perform well. That's why top performers invest heavily in their data foundations before scaling AI. They know that readiness, including data pipelines, governance, and security, determines success far more than flashy new features ever could.

-

Investments Driven By Hype, Not Fit

Companies chasing trends often burn through budgets quickly and gain little in return. The most strategic leaders analyze where companies invest in AI and learn from those patterns instead of following hype cycles. They also pay attention to emerging shifts like SEO for AI search engines, which shape how visibility and discovery work in the next wave of digital transformation. Smart firms invest with purpose, not impulse.

Common AI Investment Mistakes To Avoid

-

Spreading Budgets Too Thin

One of the biggest mistakes companies make is trying to do everything at once. When AI budgets are divided across too many small projects, impact gets diluted. The smartest leaders treat AI growth investments like any other strategic bet. This means focusing on fewer, strategic initiatives that deliver measurable results instead of doing scattered experiments that go nowhere.

-

Underinvesting In Foundations

Many organizations rush to build AI solutions without first ensuring that data quality, infrastructure, or governance are in place. That's like trying to build a skyscraper on sand. The real returns come from strong foundations, like reliable data pipelines, scalable architecture, and clear accountability across teams.

-

Treating AI As An IT Line Item

AI is a capability that touches every part of the business. When it's confined to the IT budget, opportunities for innovation in marketing, operations, and product development get missed. Cross-functional ownership ensures AI becomes a growth driver, not just a back-end tool.

-

Ignoring Organizational Readiness

Even the best strategy fails without a prepared team. Successful adoption depends on training, communication, and cultural alignment. Companies that tie learning and innovation together—think AI marketing ideas that inspire teams to explore new approaches—are the ones that build lasting momentum and real transformation.

Key Takeaway

As AI continues to reshape industries, the smartest organizations are moving from curiosity to clarity. Their AI investments aren't driven by hype but by purpose, meaning clear goals, measurable outcomes, and scalable systems that deliver lasting value. Companies that treat AI as a strategic capability rather than a one-off experiment are already seeing stronger performance and better positioning in competitive markets.

Understanding and measuring AI ROI is now a board-level priority. Leaders are rethinking AI budget allocation, ensuring every dollar supports tangible business goals, from data infrastructure and talent development to automation and innovation. The shift isn't just about adopting new tools, but also about aligning technology, people, and processes to create meaningful impact.

Looking ahead, the organizations that thrive will be those that balance innovation with responsibility. As emerging disciplines like generative engine optimization and adaptive analytics evolve, companies that learn from the hottest AI startups will stay agile and forward-thinking. The future of AI belongs to those who invest wisely, communicate transparently, and view every initiative not as an experiment, but as an opportunity to lead the next wave of intelligent growth.

FAQ

Companies are investing heavily in AI because it's seen as a strategic necessity to improve productivity, decision-making, customer experience, and long-term competitiveness. Investors expect measurable gains in revenue and efficiency from scaled AI deployments.

Experimentation usually involves small-scale pilots and proofs of concept, while AI investment means committing significant budget, infrastructure, and long-term strategy to integrate AI across core business functions rather than isolated tests.

Measuring ROI can be challenging because many benefits (like improved customer satisfaction or faster decision-making) are indirect or qualitative. Some firms track efficiency gains, cost savings, revenue increases, or productivity measures to assess outcomes.

Common hurdles include poor data infrastructure, lack of skilled talent, difficulty quantifying ROI, fragmented systems, and governance/ethical concerns, all of which can slow adoption and limit value capture.

AI is widely used for automation, customer service/chatbots, data analytics, marketing personalization, operations optimization, predictive maintenance, and product innovation, areas that can yield both efficiency and revenue impact.

Returns vary by industry and use case. Some organizations see benefits within a year, but broader enterprise deployments often take 2–5 years to deliver measurable ROI due to integration complexity and change management.